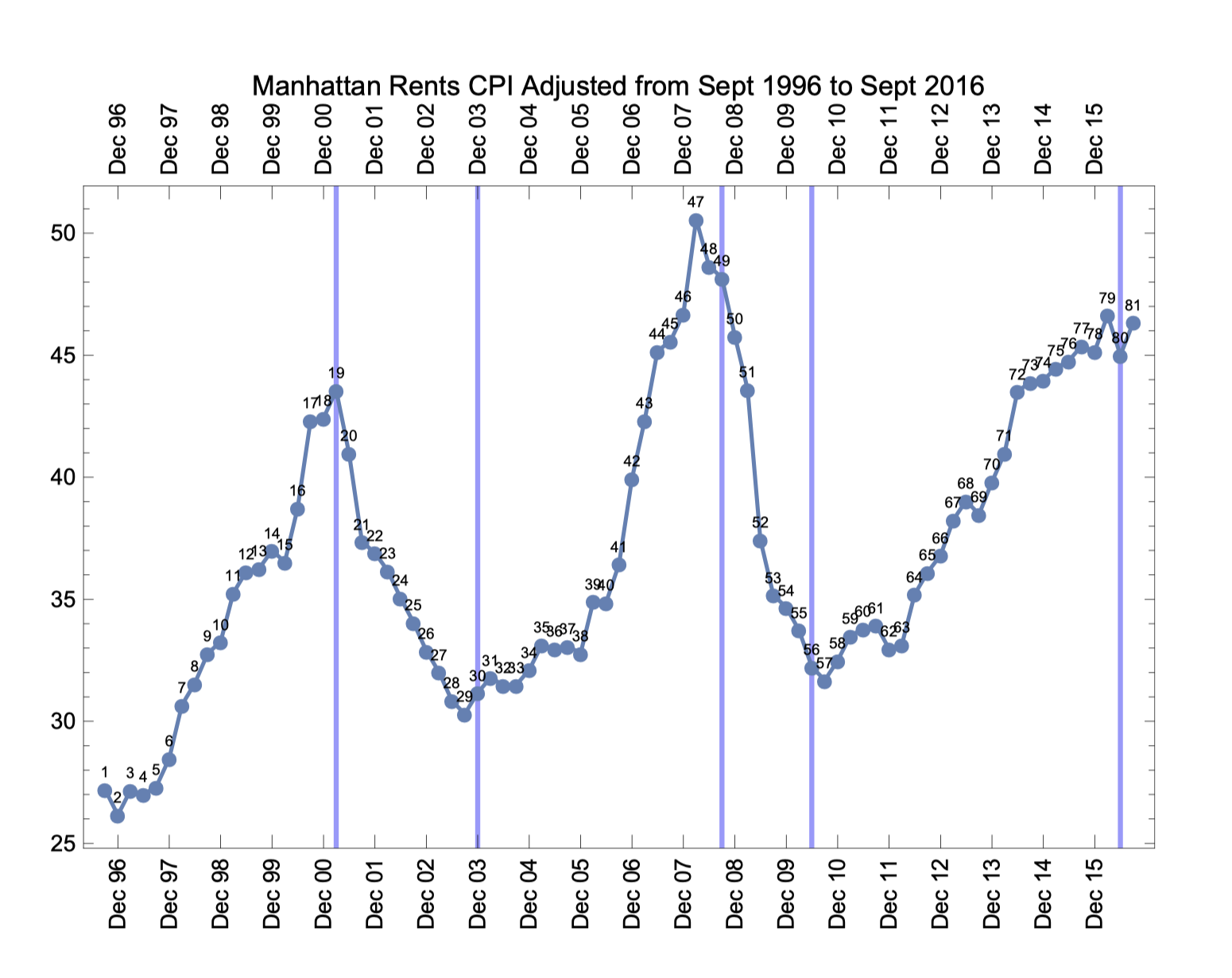

This white paper applies an algorithm for turning point prediction to the New York City commercial office market. Using office employment data as an indicator, the serial probability recursion algorithm attempts to predict peaks and troughs in asking rents (as provided by CoStar), and is tested against rental data from 1996 to 2016. The algorithm provides a continuous probabilistic assessment of the likelihood of a turning point, which can be monitored (as new data becomes available) to assess tenant strategies in an evolving market.

Commercial office rental rates in Manhattan change gradually over time, with typical cycles taking between four and twenty years. Like all financial time series, the rental rate cycle has noise in the data, so it it sometimes difficult to assess a turning point. Understanding the point at which the series inflects is extremely useful in planning the long term process required to find, negotiate for, and construct office space, particularly for larger tenants.

It should be possible in theory to develop demand-side leading indicators that precede the slow-motion changes in supply, or at the minimum to confirm the observation of turning points in rental rates. One method is described in this paper: